The Dow Jones Industrial Average in the US tumbled last week. But the Indian benchmark indices managed to stay afloat and were down marginally. The Dow Jones tumbled 5 per cent intraweek. The Indian benchmark indices were down in the range of 0.7 to 0.9 per cent last week. Increased uncertainty over Trump’s tariff policies and the fear of the trade war intensifying knocked down the US markets badly.

For now, the Indian equities are showing some signs of resilience. It could be because of the fact that the Indian benchmark indices have already fallen so much. It is important now to see if the Sensex and Nifty can continue to avoid sharp fall from current levels. It would be very difficult to completely stay insulated from the impact of the sell-off in the US. So, there are chances that the Indian indices may fall at a much slower pace than the US or stay in a sideways range for some time.

All sectoral indices ended in red last week. The BSE IT index, down 4.84 per cent fell the most.

FPIs sell

The Foreign Portfolio Investors (FPIs) continue to sell Indian equities. However, the quantum of selling slowed down last week. The equity segment saw an outflow of about $603 million last week. The first half of March has seen a net outflow of about $3.44 billion so far. As we have been mentioning over the last few weeks, unless the FPIs start to buy, the Sensex and Nifty are likely to remain subdued.

Video Credit: Businessline

Nifty 50 (22,397.20)

Nifty was broadly range-bound and stable all through the week. The index failed in its attempts to breach the resistance at 22,650. It oscillated between 22,315 and 22,677 and closed the week at 22,397.20, down 0.69 per cent.

Short-term view: The immediate outlook is mixed. Considering the weakness in the global equities, the bias is likely to remain negative. The region between 22,600 and 22,650 will continue to remain as a strong resistance. As long as the Nifty stays below 22,650, the chances of it falling back to 22,000-21,950 cannot be ruled out. A break below 22,300 will trigger this fall. If the Nifty declines below 21,950, then there can be an extended fall to 21,700-21,600.

A sustained rise above 22,650 is needed to go up to 22,800-22,850 first. An eventual break above 22,850 will then clear the way for a rise to 23,000-23,100.

Looking at the weekly chart, 21,950-22,700 can be the broad trading range for some time now. A breakout on either side of this range will then determine the next move.

Chart Source: TradingView

Medium-term view: Crucial support is in the 21,700-21,500 region. Resistance to watch will be the 23,500-23,650 region. So, 21,500-23,650 is the wide trading range we can look for now. There are chances to see a sideways consolidation between 21,500 and 23,650 for a few months now.

If the Nifty manages to sustain above 21,500 amid the global sell-off, then it will keep the chances high of breaking above 23,650. It will also keep alive our broader bullish view of seeing 28,000-28,500 on the upside. May be that this rise would get delayed than previously expected.

On the other hand, if Nifty breaks below 21,500, it will come under more selling pressure. Such a break can drag it down to 21,000 and even 19,600, in a worst-case scenario. The fall below 21,500 will then completely negate our bullish view.

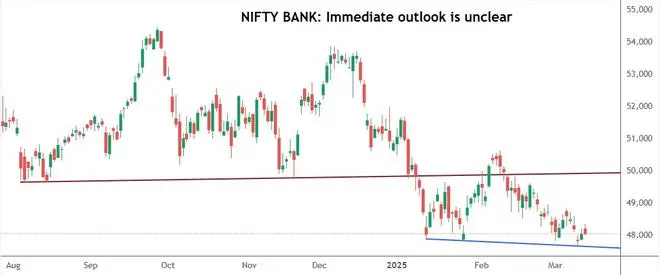

Nifty Bank (48,060.40)

Nifty Bank traded lower and stable all through last week. The index was stuck in between 47,700 and 48,600. It has closed the week at 48,060.40, down 0.9 per cent.

Short-term view: The immediate outlook is unclear. Support is in the 47,800-47,700. Resistance is at 49,000. A breakout on either side of 47,700-49,000 will decide the next leg of move.

A break below 47,700 will be bearish. Such a break can take the index down to 47,300 initially. A further break below 47,300 can drag it down to 46,600.

On the other hand, Nifty Bank index will get a breather if it breaks above 49,000. In that case, a rise to 50,000-50,200 is possible.

Chart Source: TradingView

Medium-term view: There is no change in the medium-term outlook. We see 46,600 as a crucial support which is expected to limit the downside. As long as the index remains above 46,600, the bias is positive to breach 50,200 eventually. Such a break can take the index up to 53,000-54,000 over the medium term. It will also keep the doors open to see 58,000 on the upside from a long-term perspective.

The view will go wrong only if the index declines below 46,600. If that happens, we can see a fall to 456,000-45,700.

Sensex (73,829.91)

Sensex oscillated around 74,000 most part of the week. It has closed the week at 73,829.91, down 0.68 per cent.

Short-term view: The outlook is unclear. Support is at 72,700-72,600. Resistance is at 74,900 and 75,100. So broadly, 72,600-75,100 can be the trading range for the short term. A breakout on either side of 72,600 or 75,100 will determine the next leg of move.

A break above 75,100 will be bullish. It can take the Sensex up to 76,000-76,500. On the other hand, a break below 72,600 can drag the index down to 71,800 first. A further break below 71,800 will take it down to 71,000.

Chart Source: TradingView

Medium-term view: We repeat that 71,000-70,700 is a strong support which we expect to hold. Resistance is in the 75,000-76,000 region. As long as the index stays above 70,700 the bias will remain positive to breach 76,000 and rise to 80,000 over the medium term.

This view will go wrong if Sensex declines below 70,700. That will bring in the danger of seeing 66,000 on the downside.

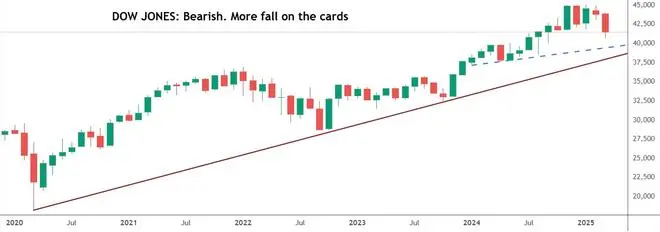

Dow Jones (41,488.20)

The Dow Jones Industrial Average broke below 41,600 and tumbled about 5 per cent intraweek to a low of 40,661.77. On Friday, it has bounced and recovered to close the week at 41,488.20, down 3 per cent.

Chart Source: TradingView

Outlook: The fall last week confirms a double-top pattern on the chart. Resistance is in the 42,000-42,100 region. A corrective rise to 42,000-42,100 in the near term is a possibility. But the broader view remains bearish. Dow Jones can fall to 40,000, and even 39,000-38,500, in the coming weeks.